Offer flexible credit at the point of sale—online or in-store—with a platform that gives you full control over the experience, the risk, and the growth.

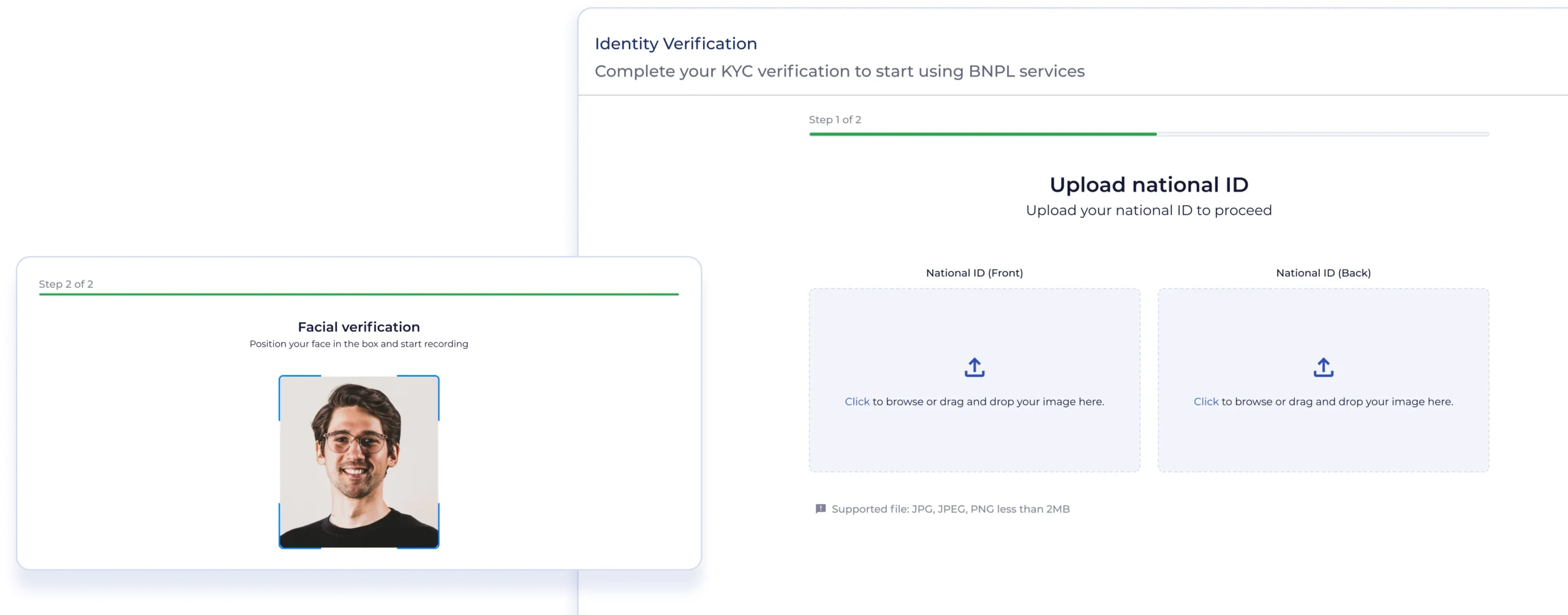

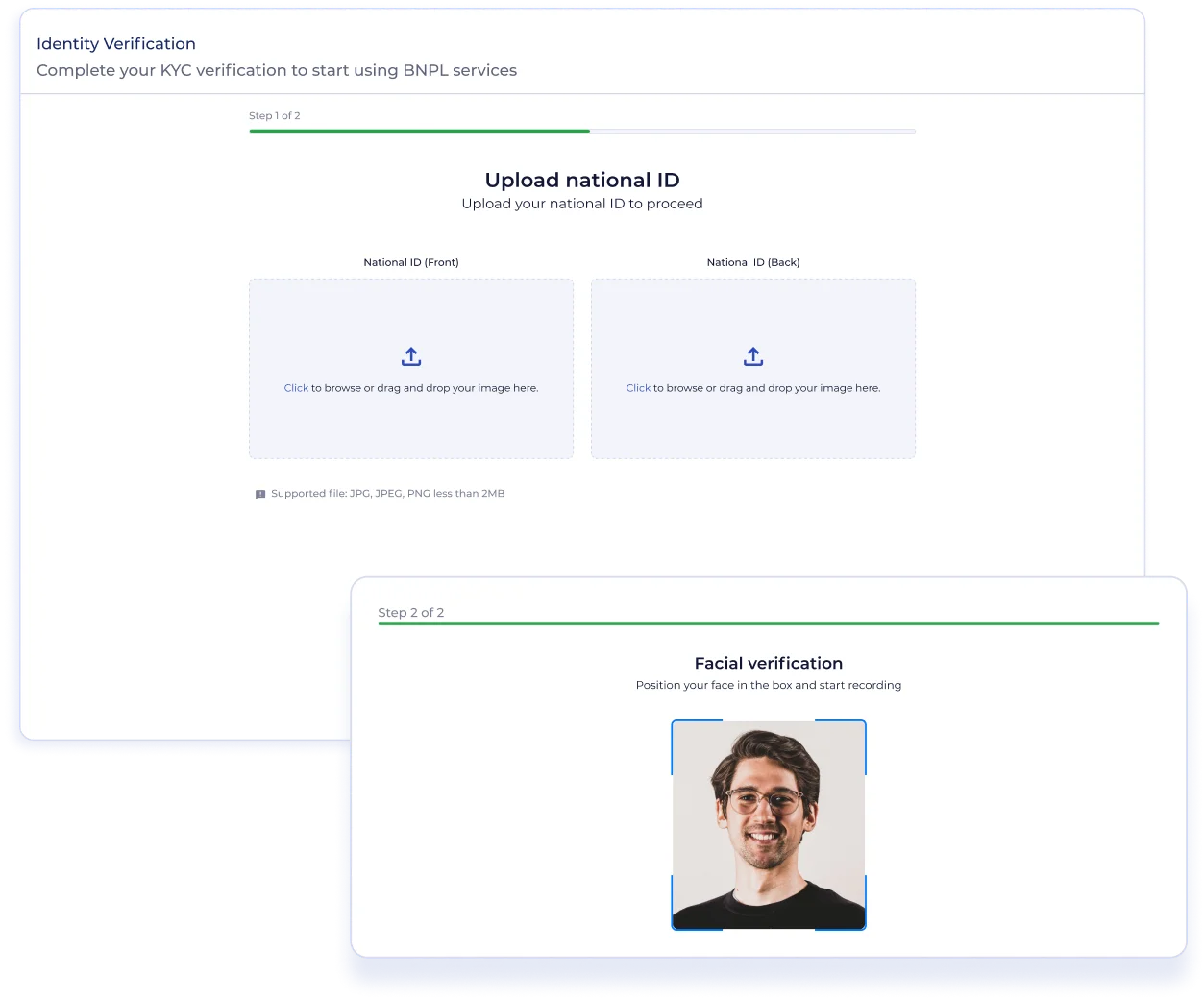

Real-time ID checks, AML screening, and document capture—optimized for individuals and businesses across MENA and Pakistan.

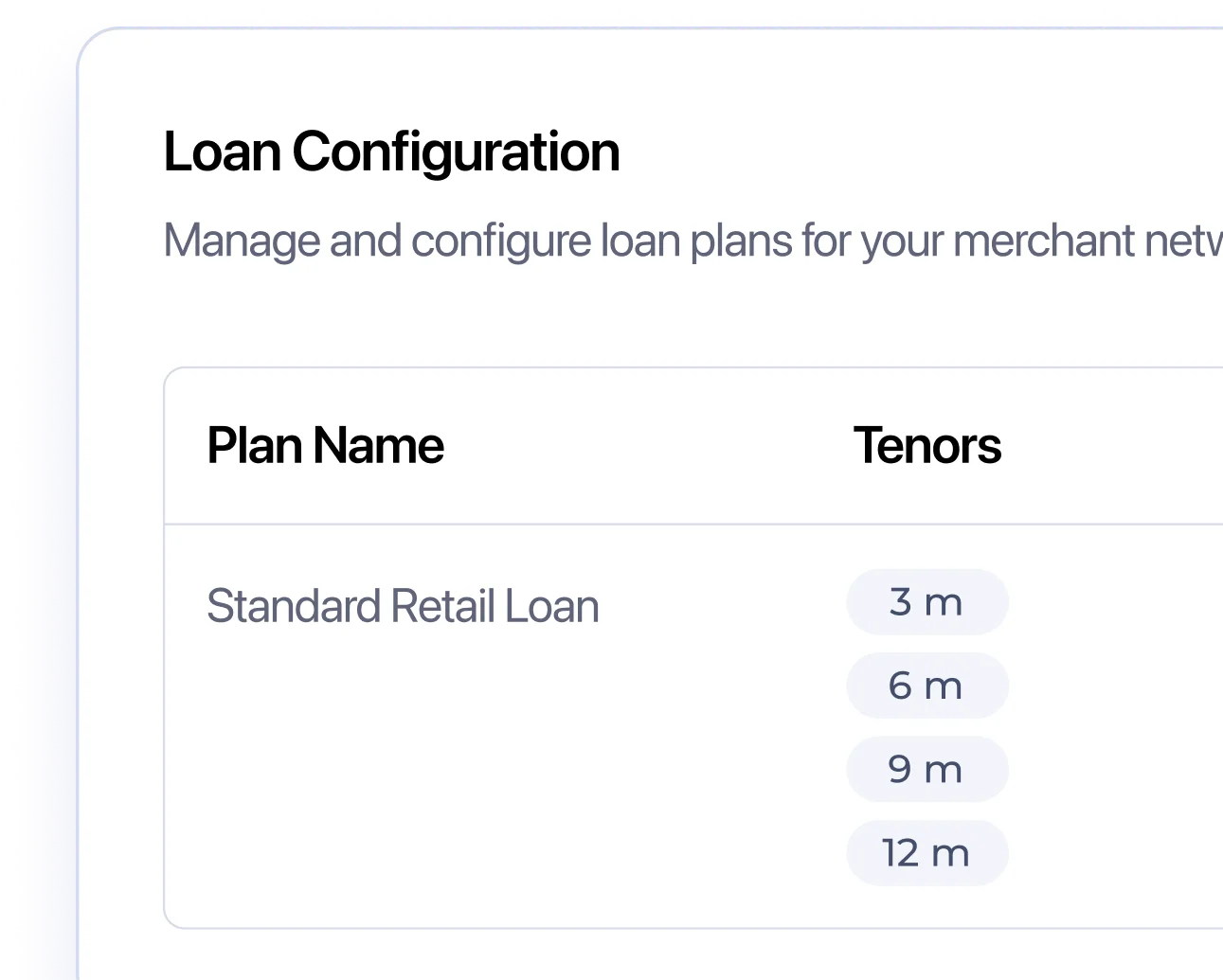

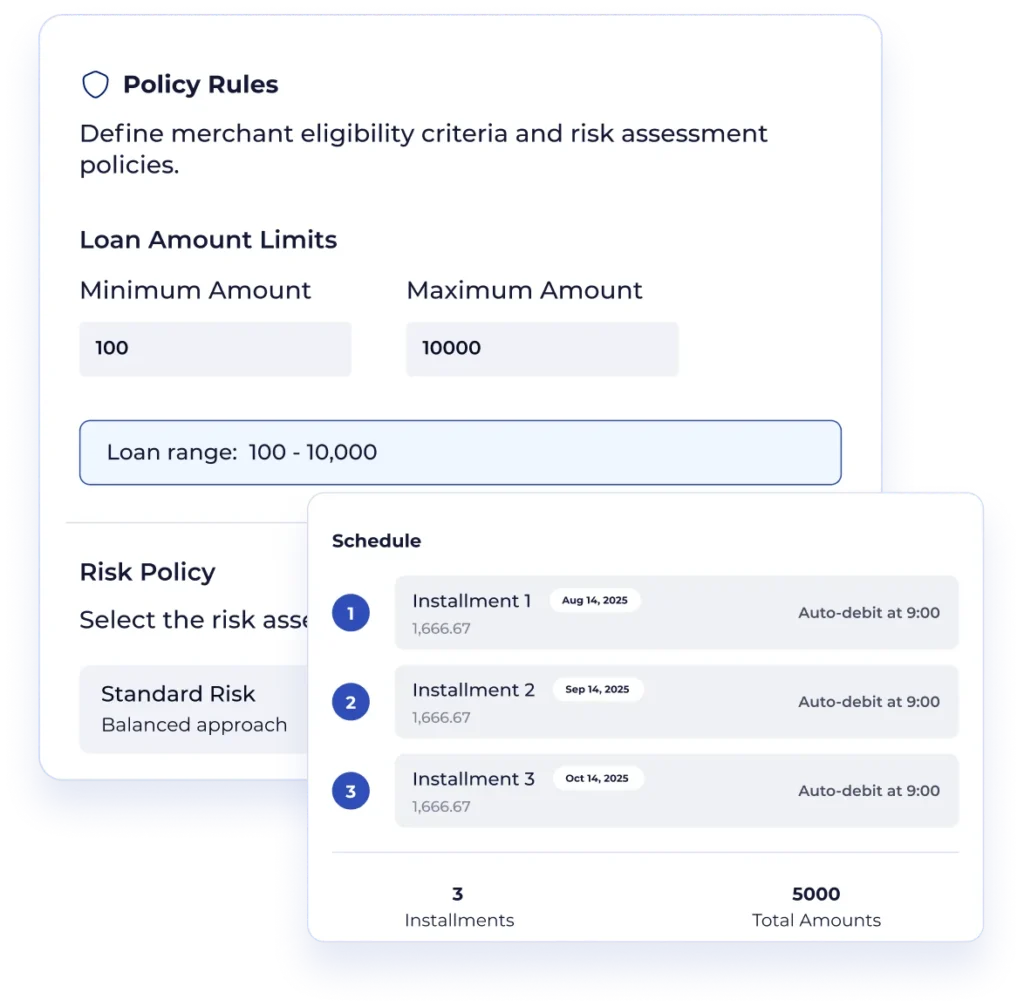

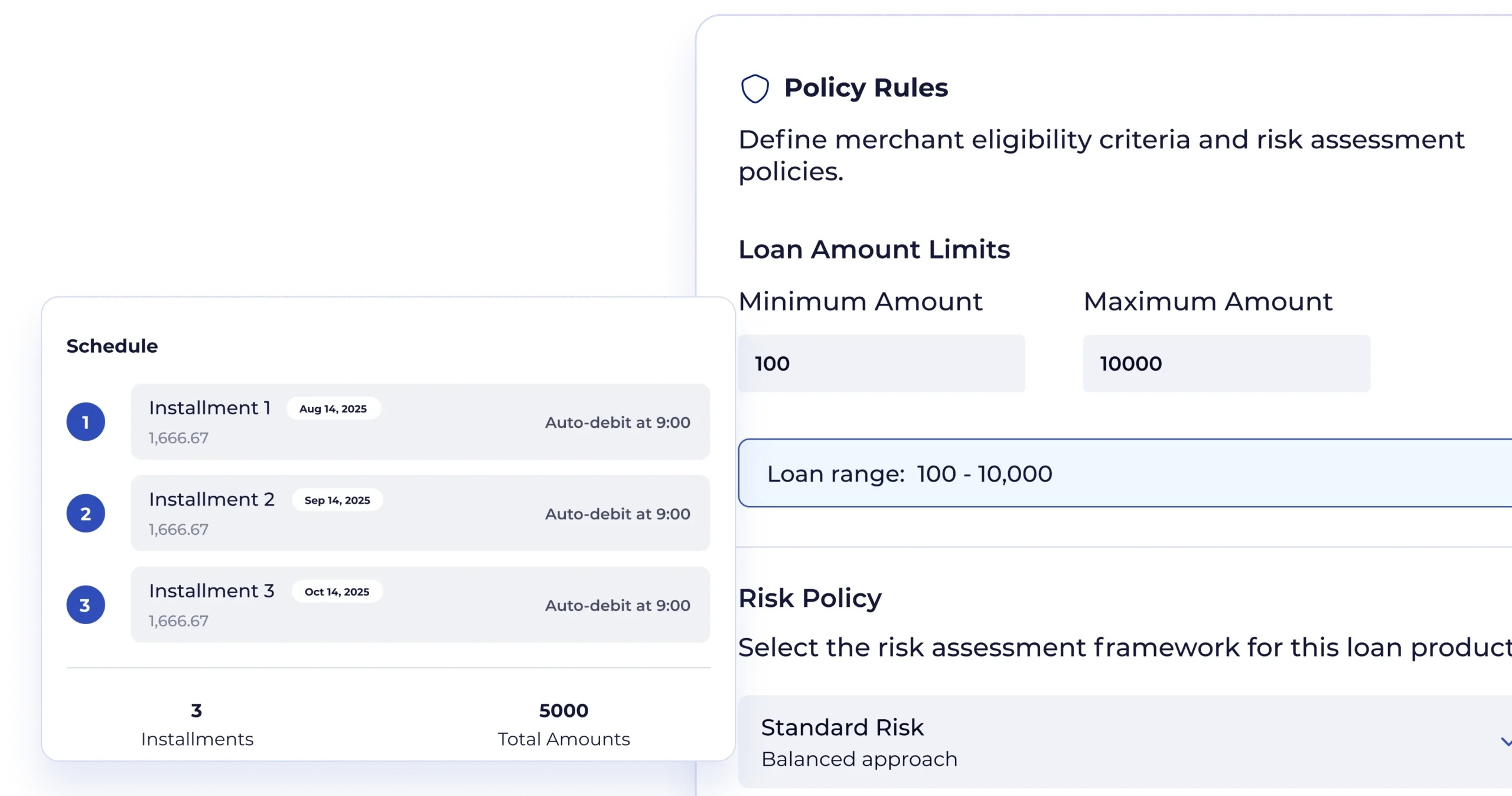

Control tenors, limits, grace periods, and merchant rules from a configurable dashboard.

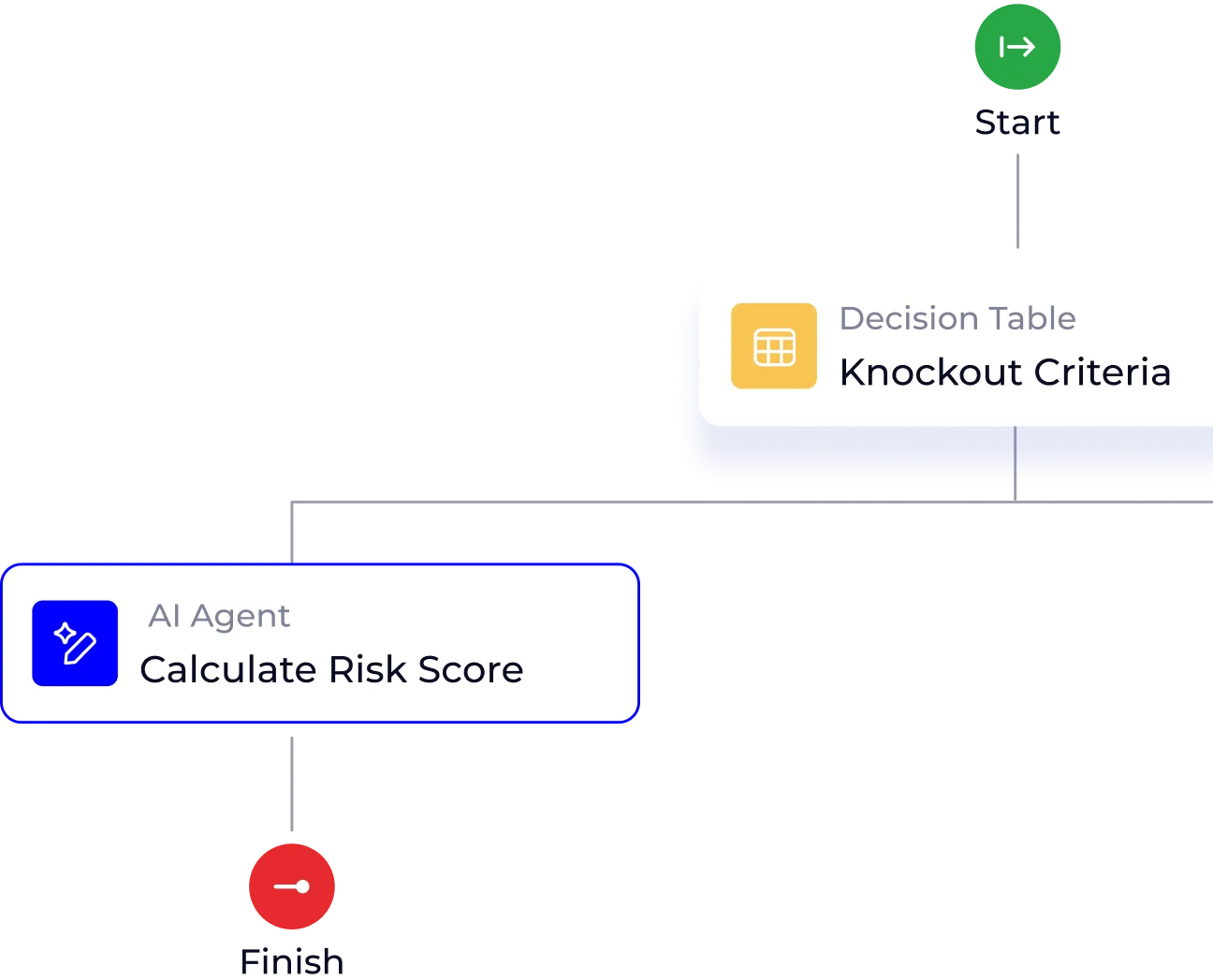

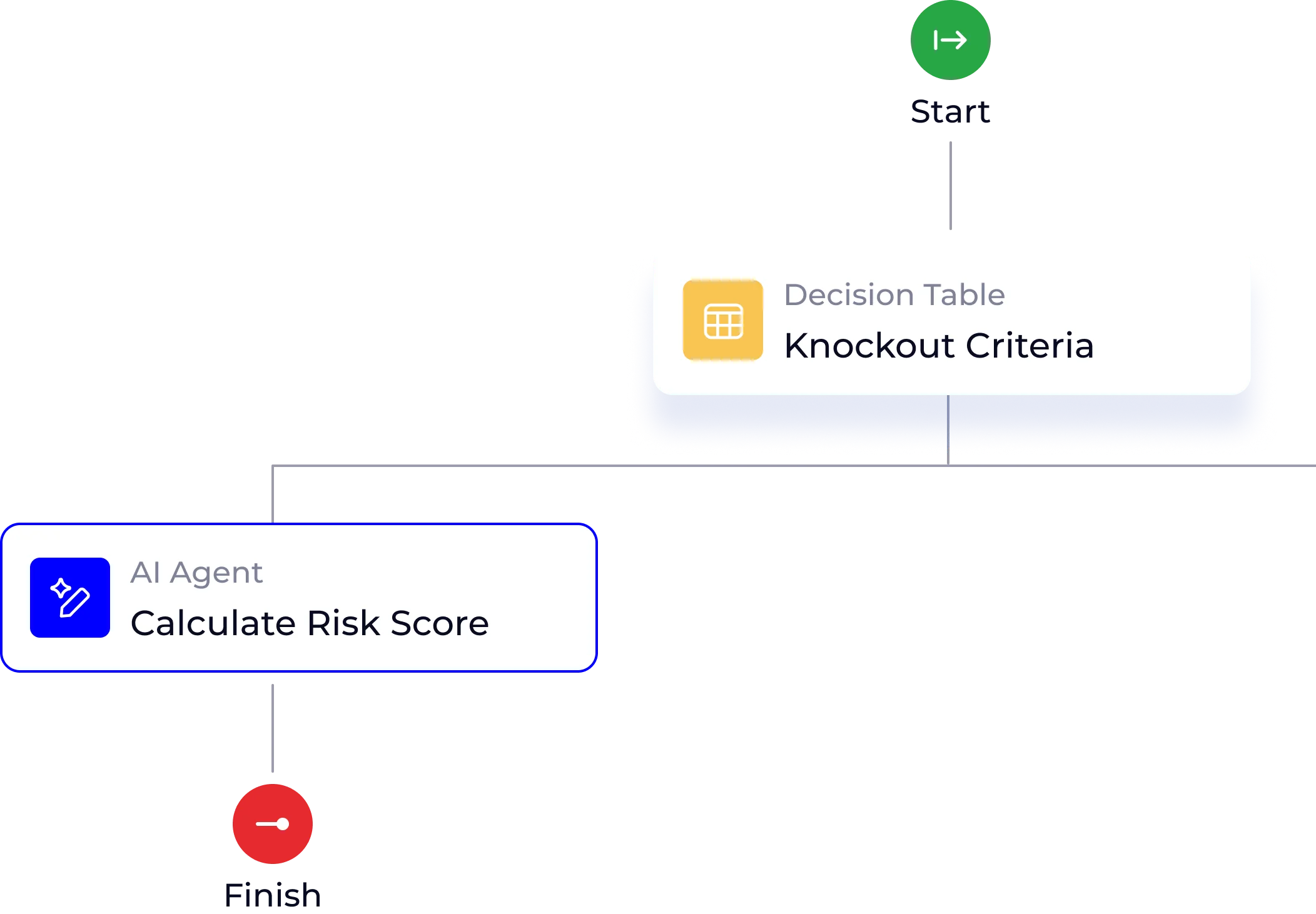

Use a drag-and-drop builder to set your own rules, thresholds, and scoring flows—no developer required.

Support pay-in-3, monthly, or deferred models with auto-scheduling and tracking based on your policies.

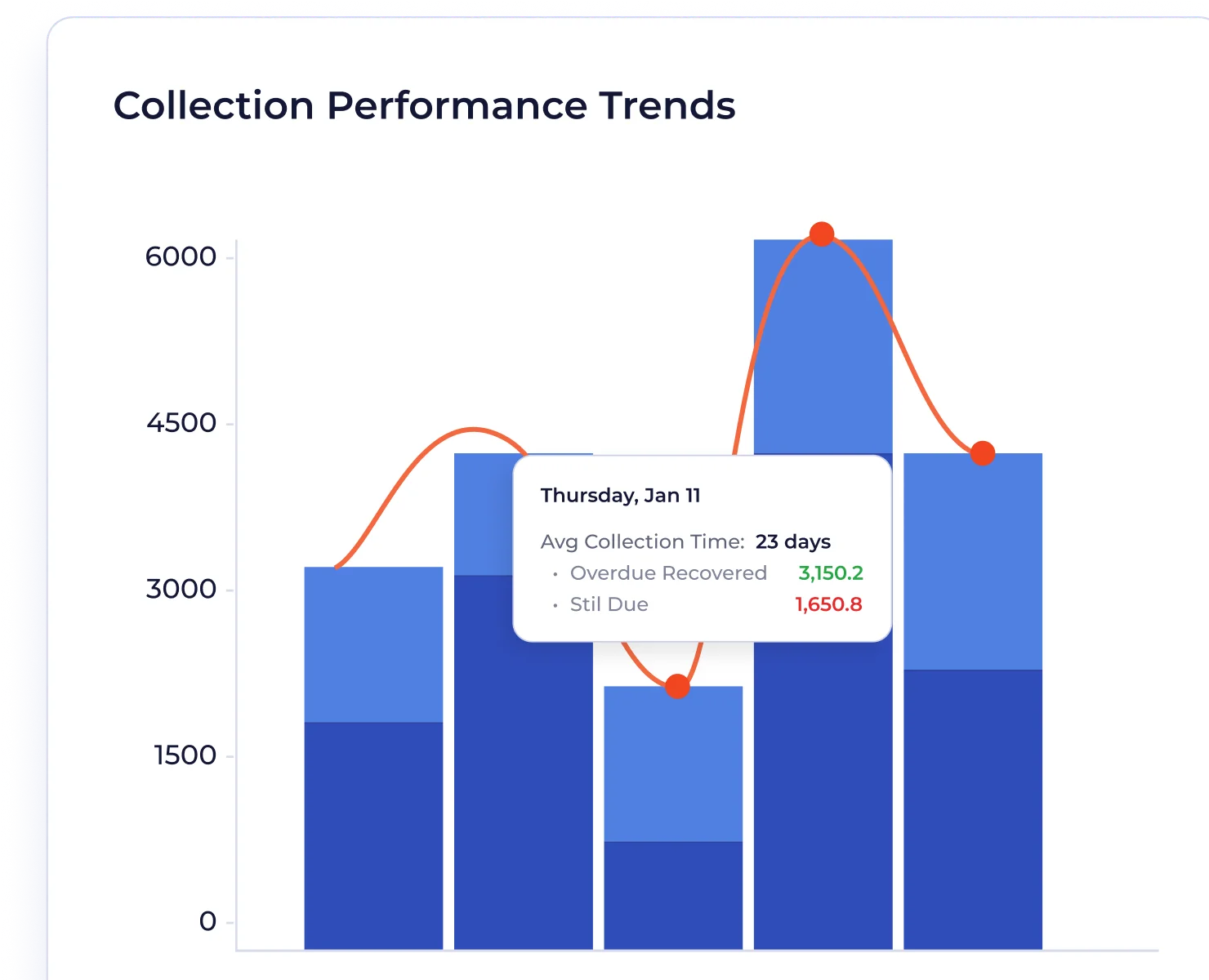

Automate reminders, retries, and escalations—customized to your strategy and customer lifecycle.

Deploy BNPL online or in-store with integrations for Shopify, Magento, WooCommerce, and custom-built platforms.

Get to market in weeks—not months—with full platform support

Use the full BNPL stack or select only what you need

Serve regulated and unregulated markets with confidence

APIs, SDKs, plugins, and white-labeled flows designed for speed

Join the banks, telcos, and fintechs building BNPL programs with a platform designed for control, speed, and compliance.

NymCard values your privacy and seeks to protect it.

You can view our Privacy Policy and Cookie Policy for more details.