Launch debit cards with the infrastructure, controls, and compliance built for the Kingdom’s growing digital economy.

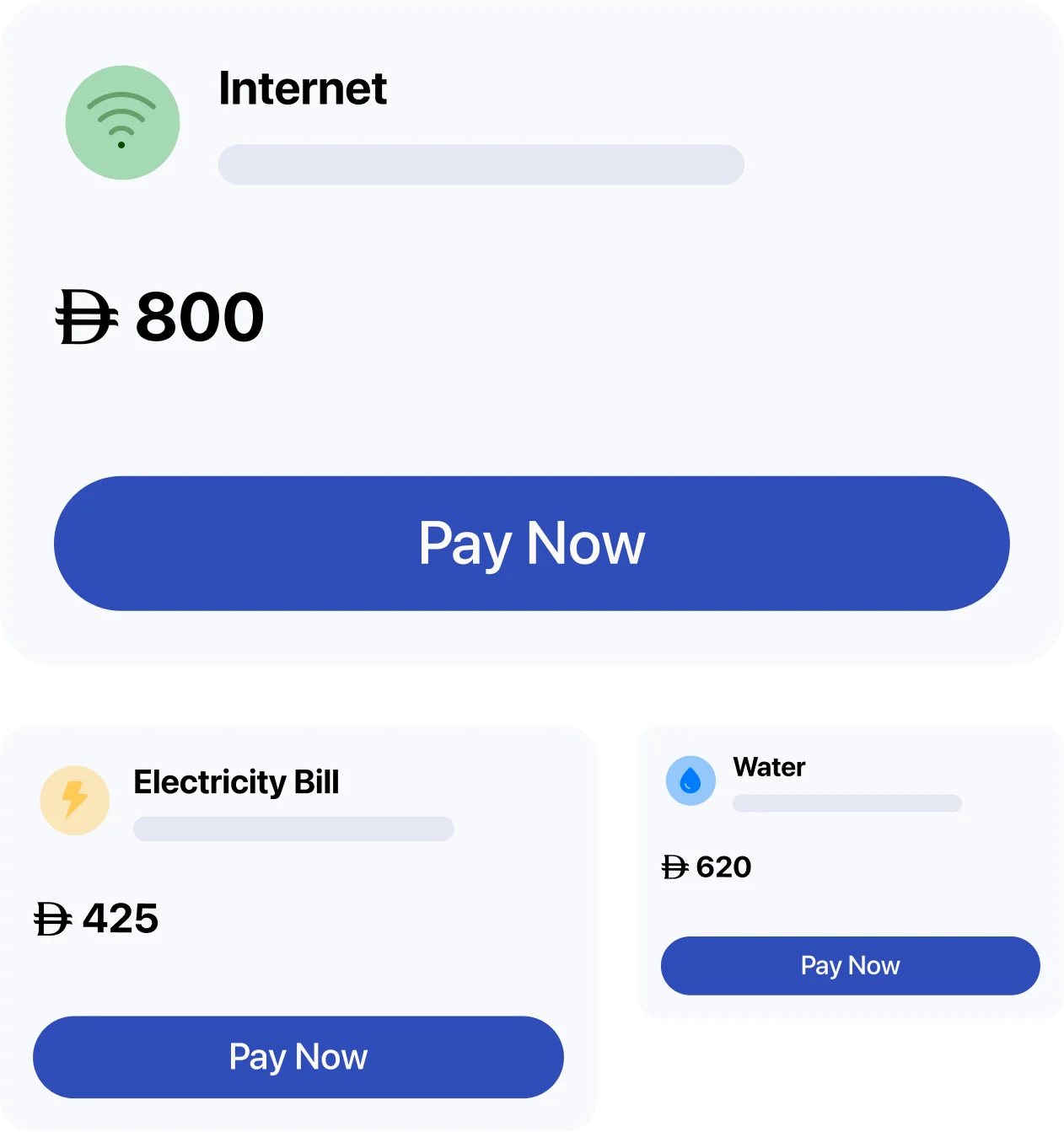

From ATM withdrawals and POS purchases to wallet and account integrations—our debit card infrastructure is built for how users transact today.

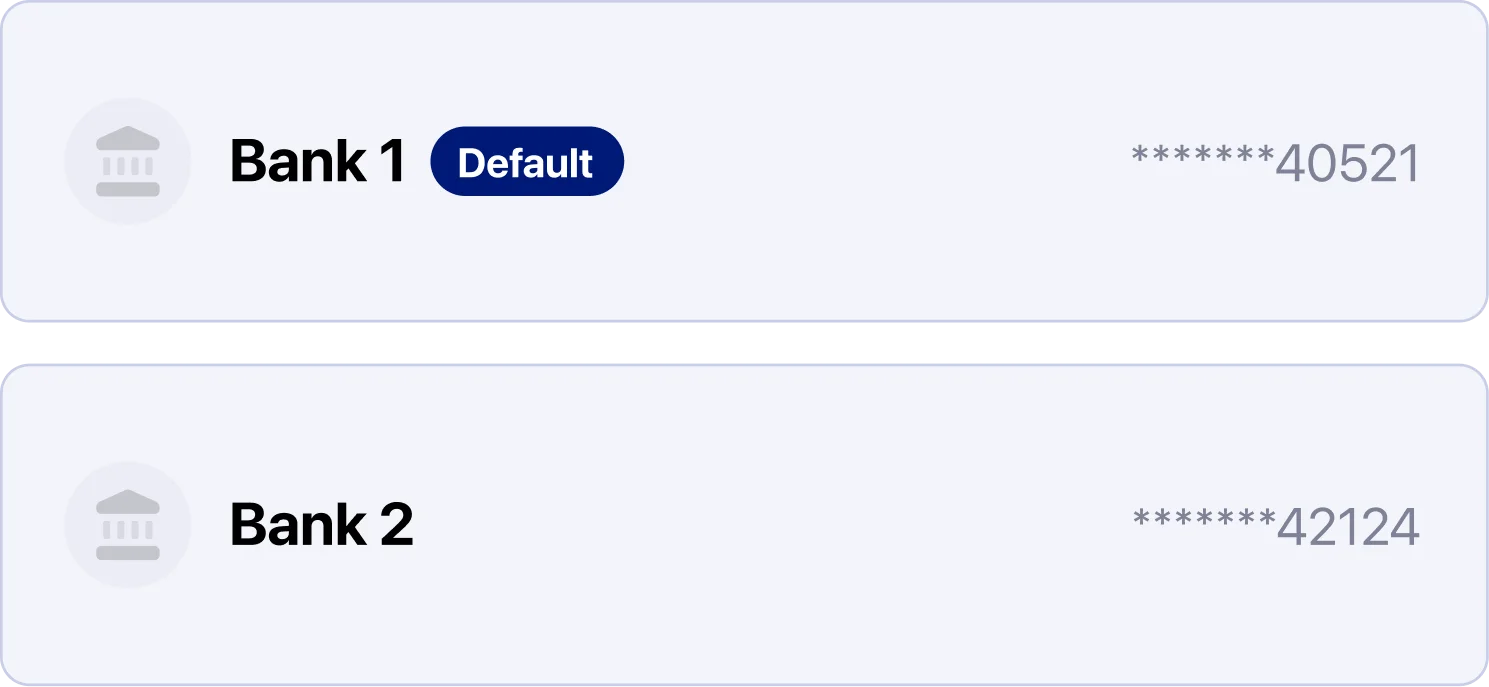

Connect debit cards to wallets or traditional accounts seamlessly.

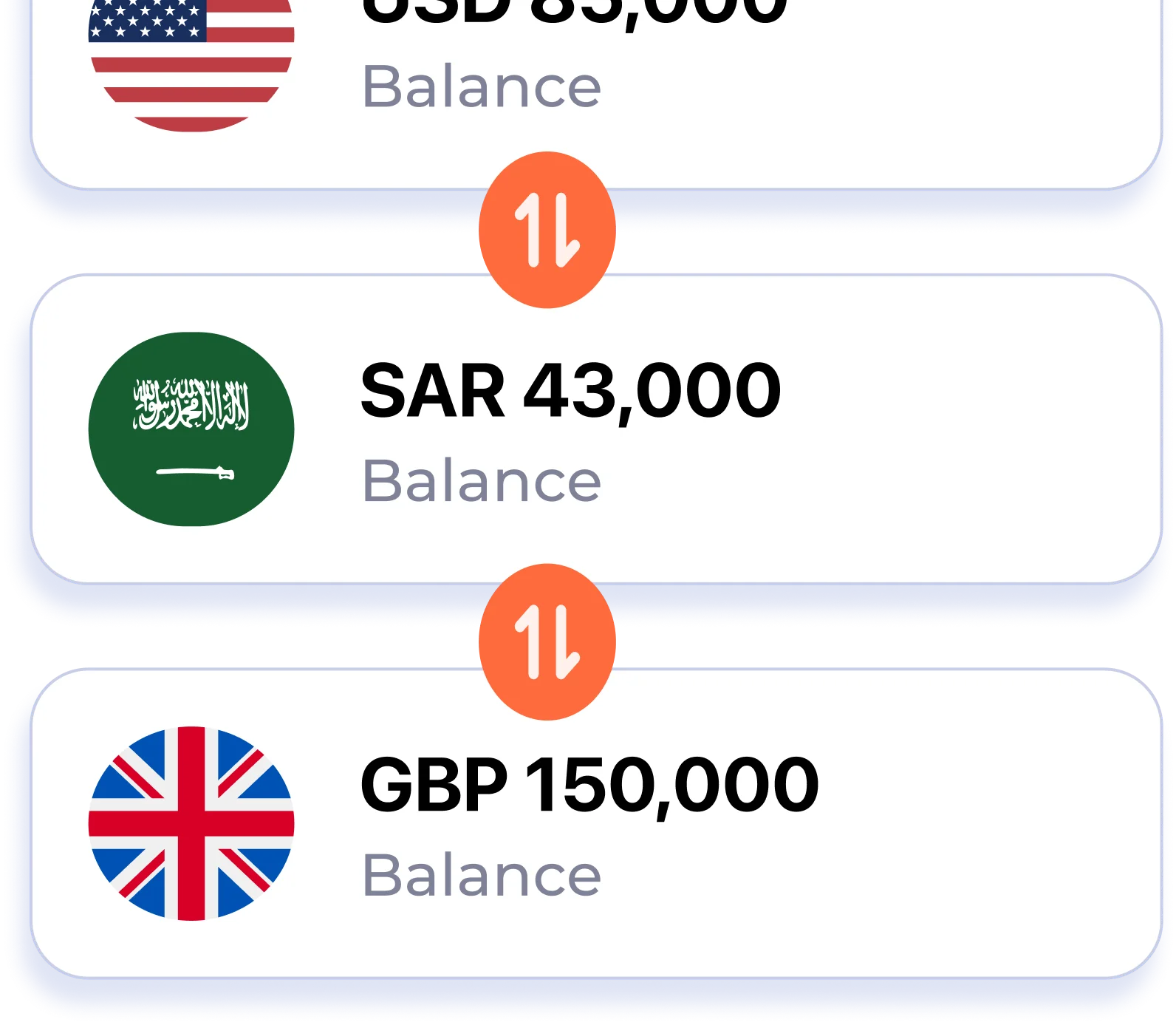

Issue cards in one or multiple currencies, with full FX support.

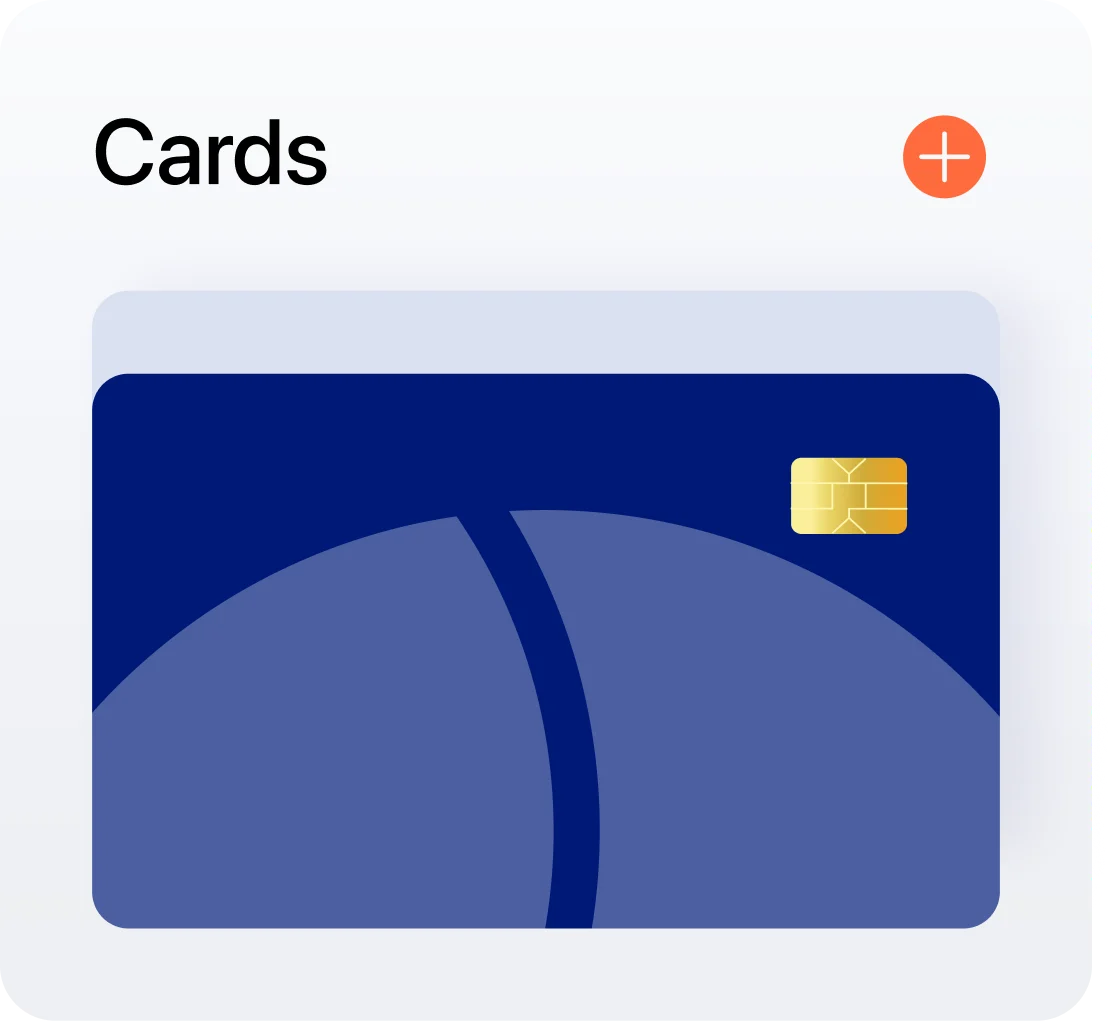

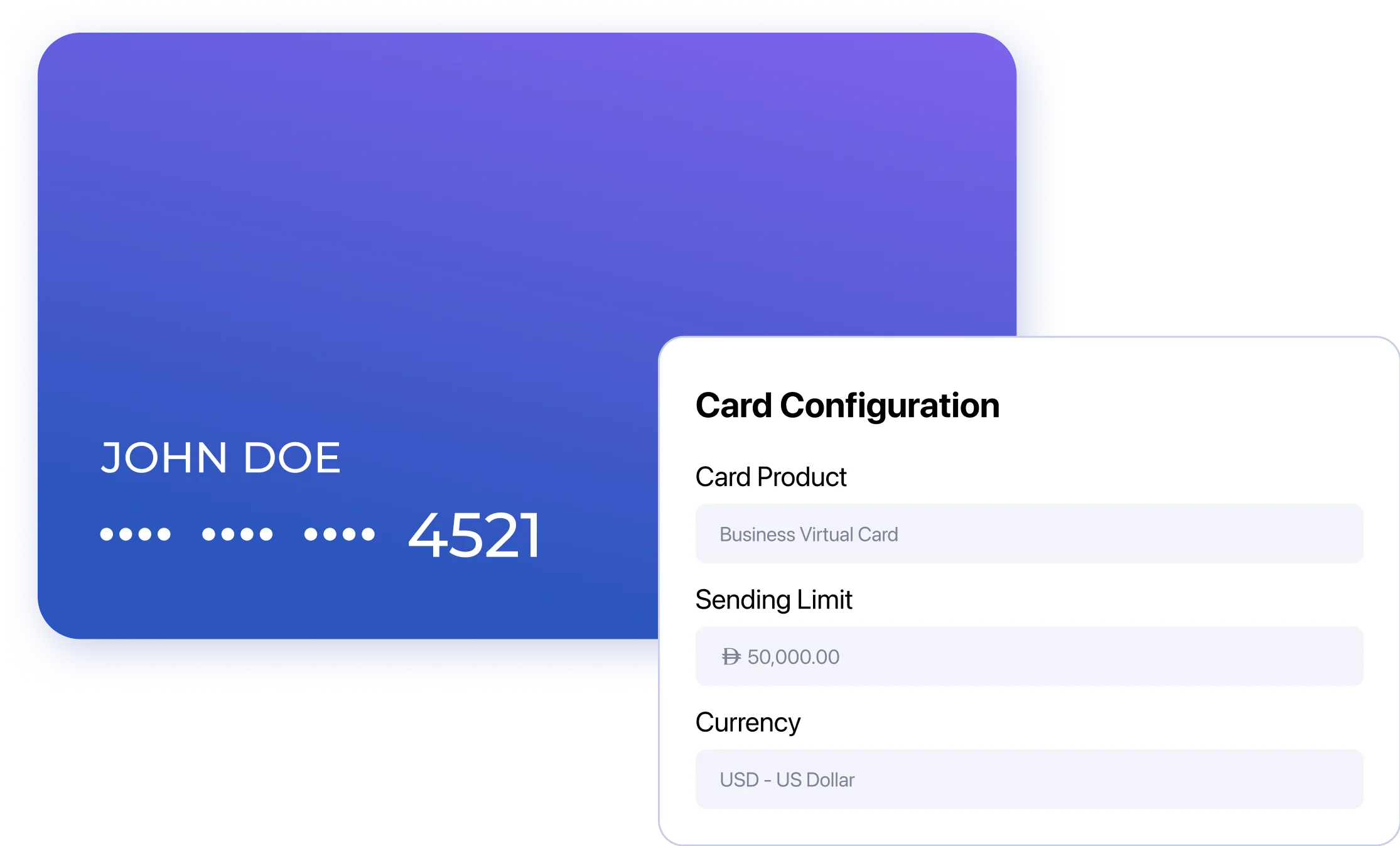

Create and activate debit cards instantly via APIs or white-label flows.

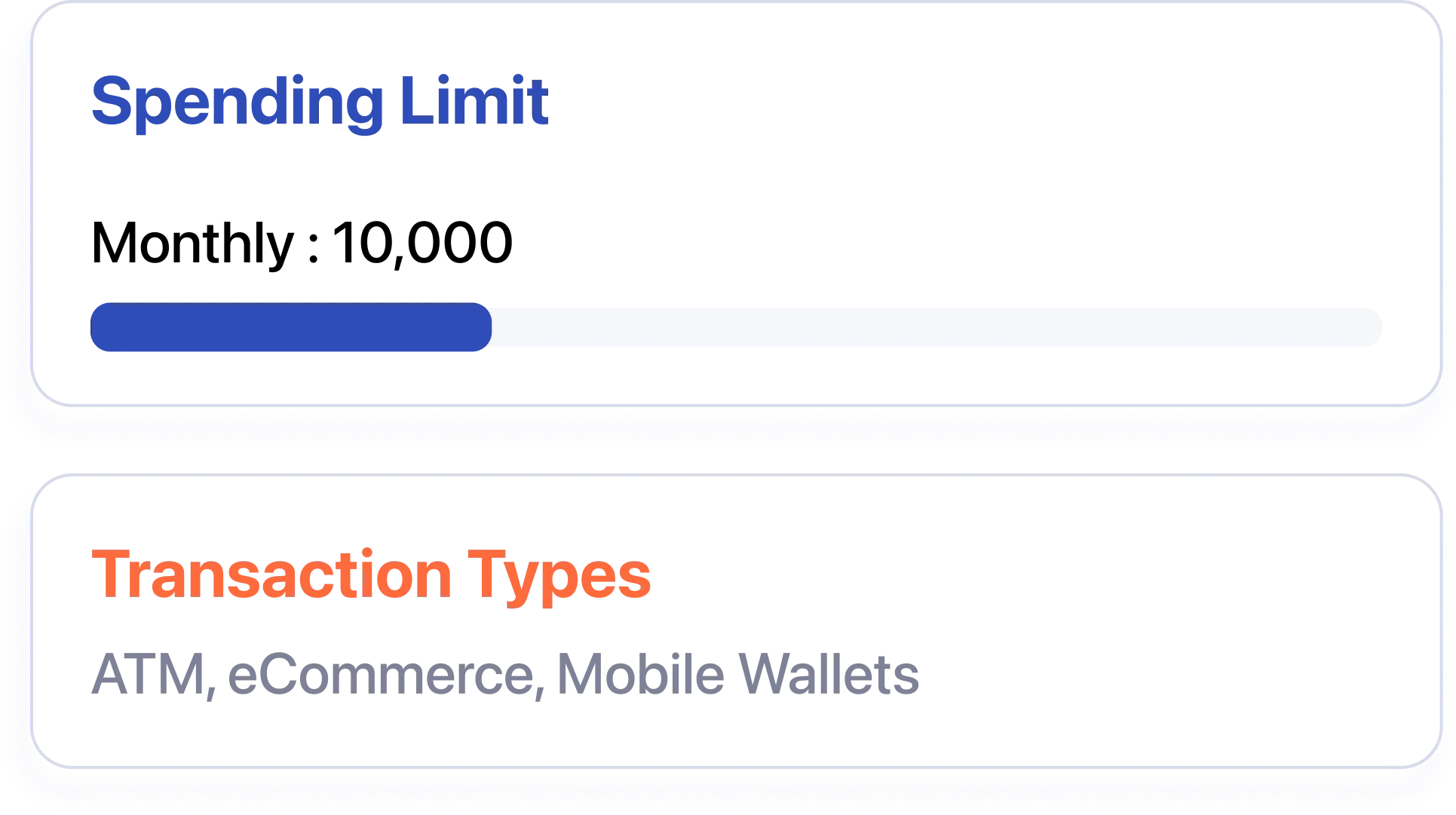

Set card limits by user, transaction type, or timeframe.

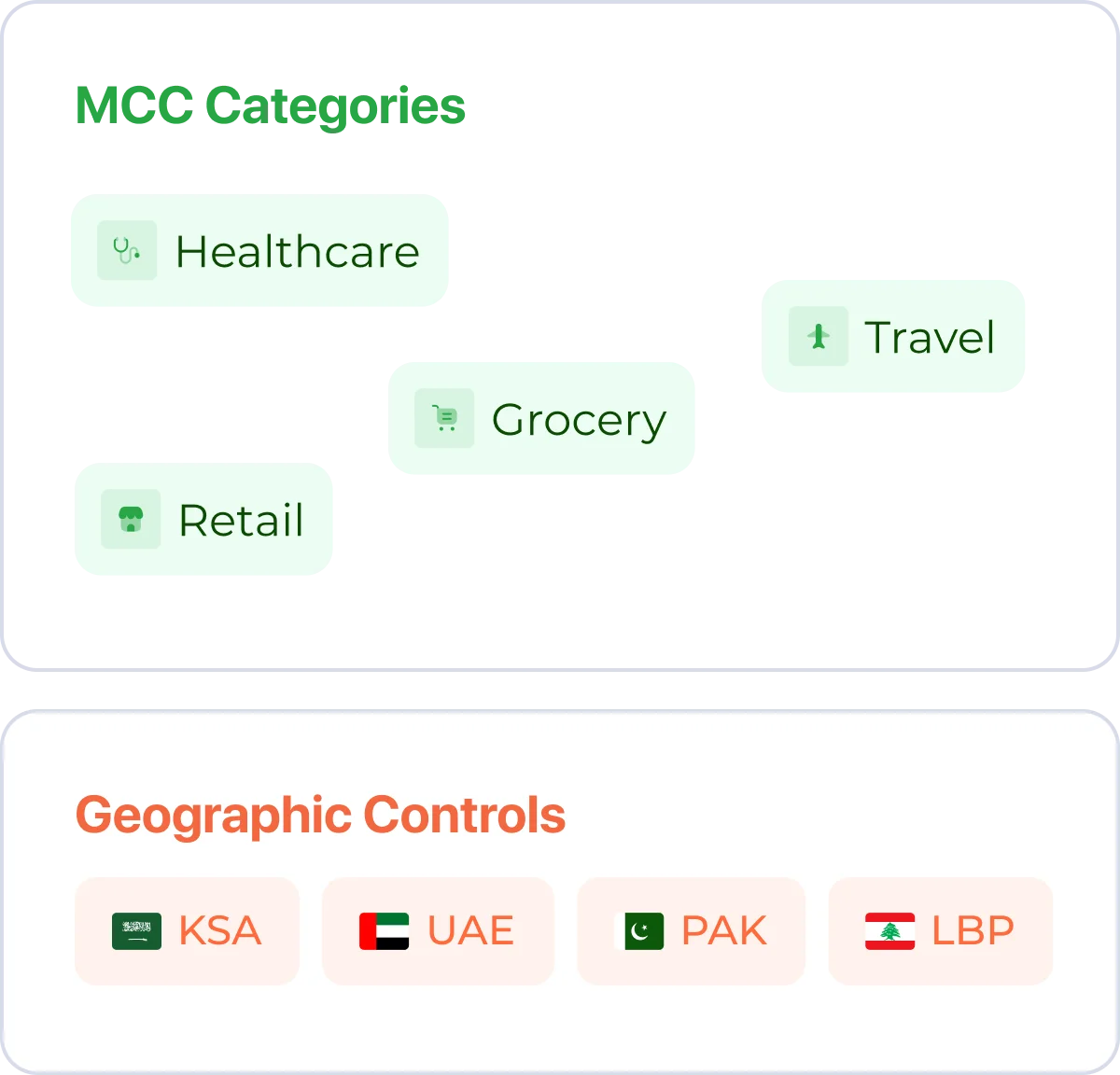

Control where and how each card is used.

Approve transactions based on real-time logic.

Cards work across all standard acceptance points globally.

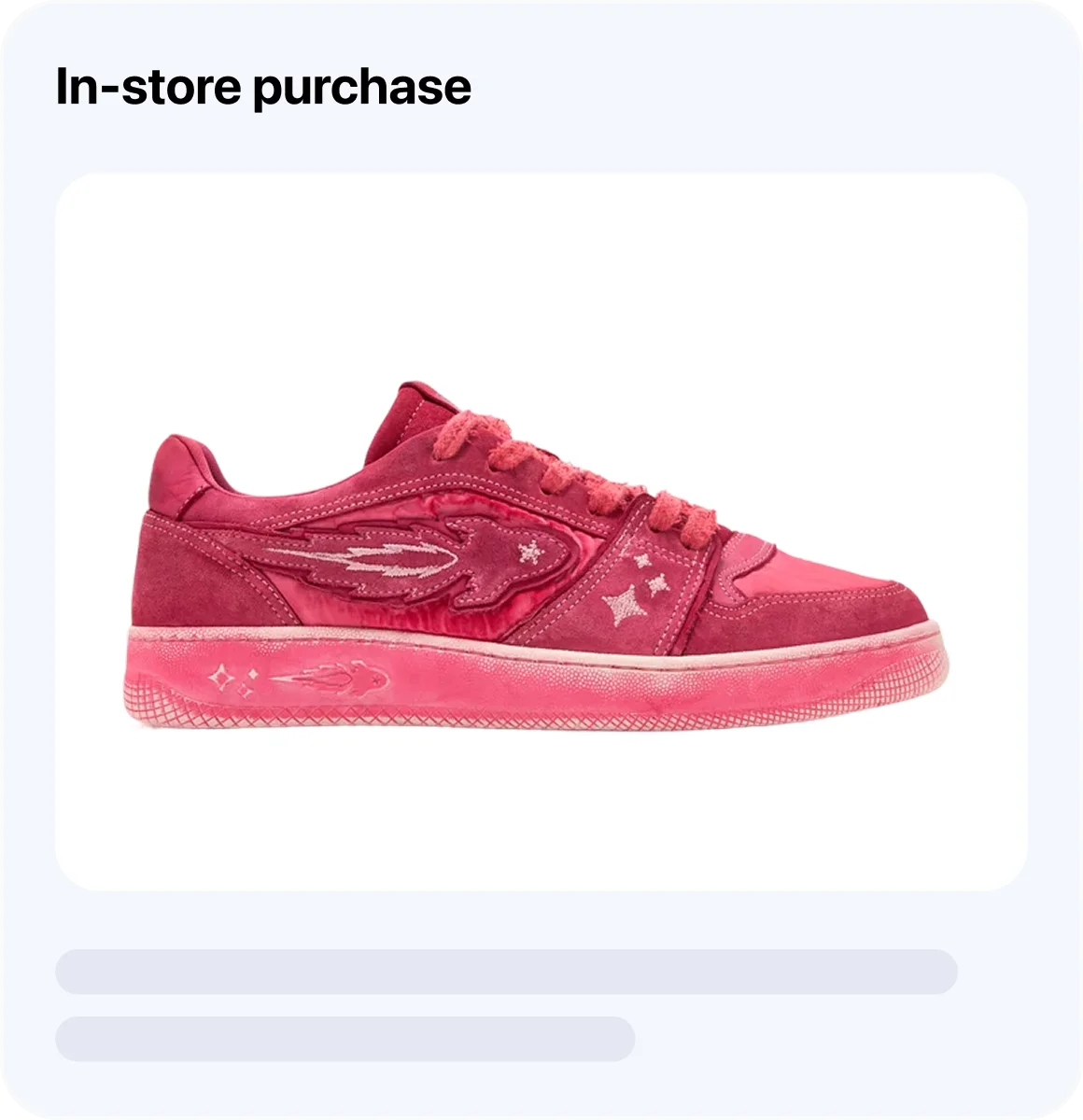

Offer users flexibility in how they pay—online, in-store, or in-app.

Connect instantly to Visa, Mastercard, and regional networks.

Add operational and compliance tools that help you scale with confidence.

Verify users and onboard individuals or businesses with confidence.

Detect suspicious activity in real time and block risky transactions.

Secure online payments with built-in authentication.

Ensure timely reconciliation and transparent settlement flows.

Manage chargebacks, investigations, and resolution workflows.

Outsource customer support with trained prepaid specialists.

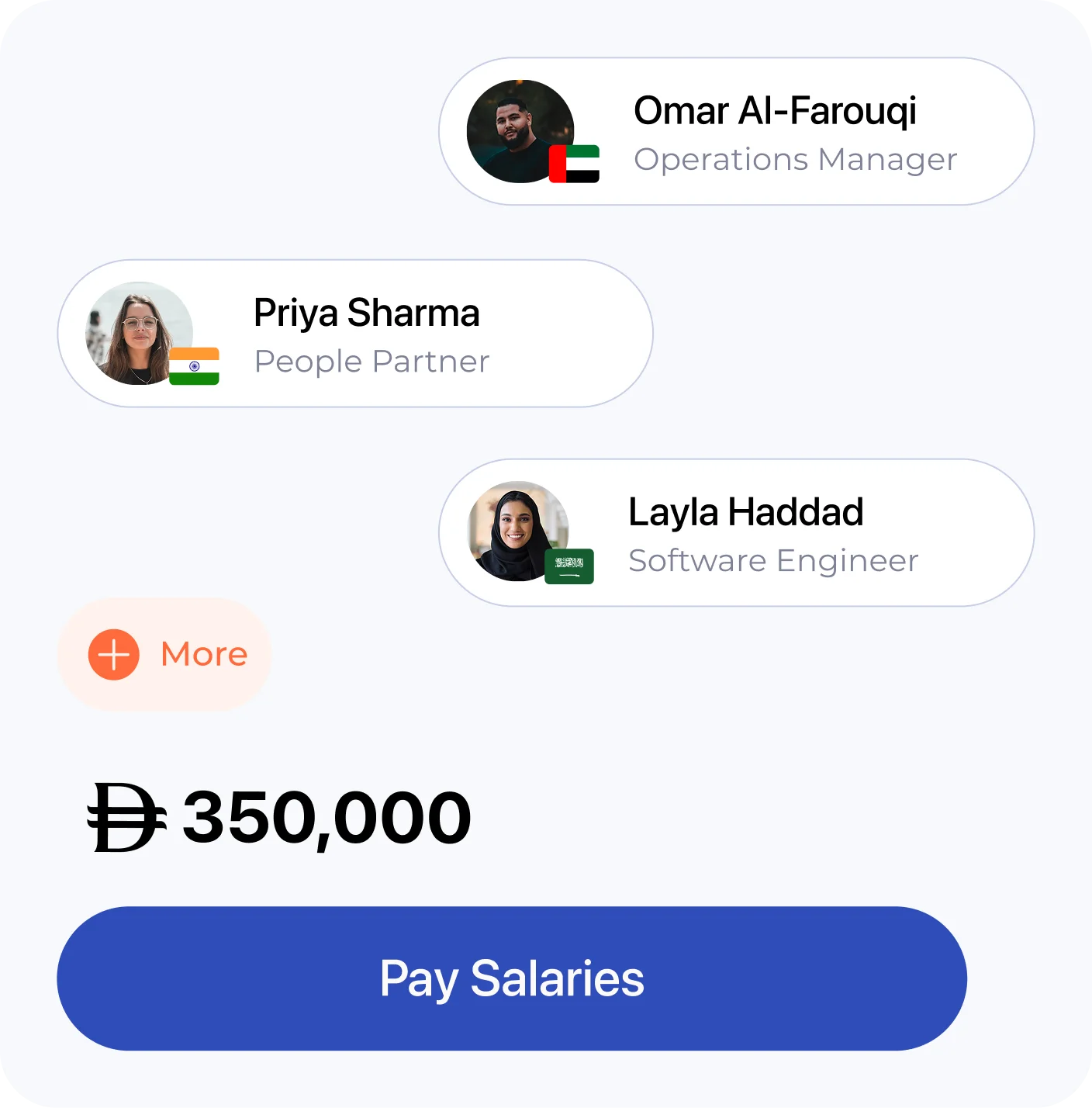

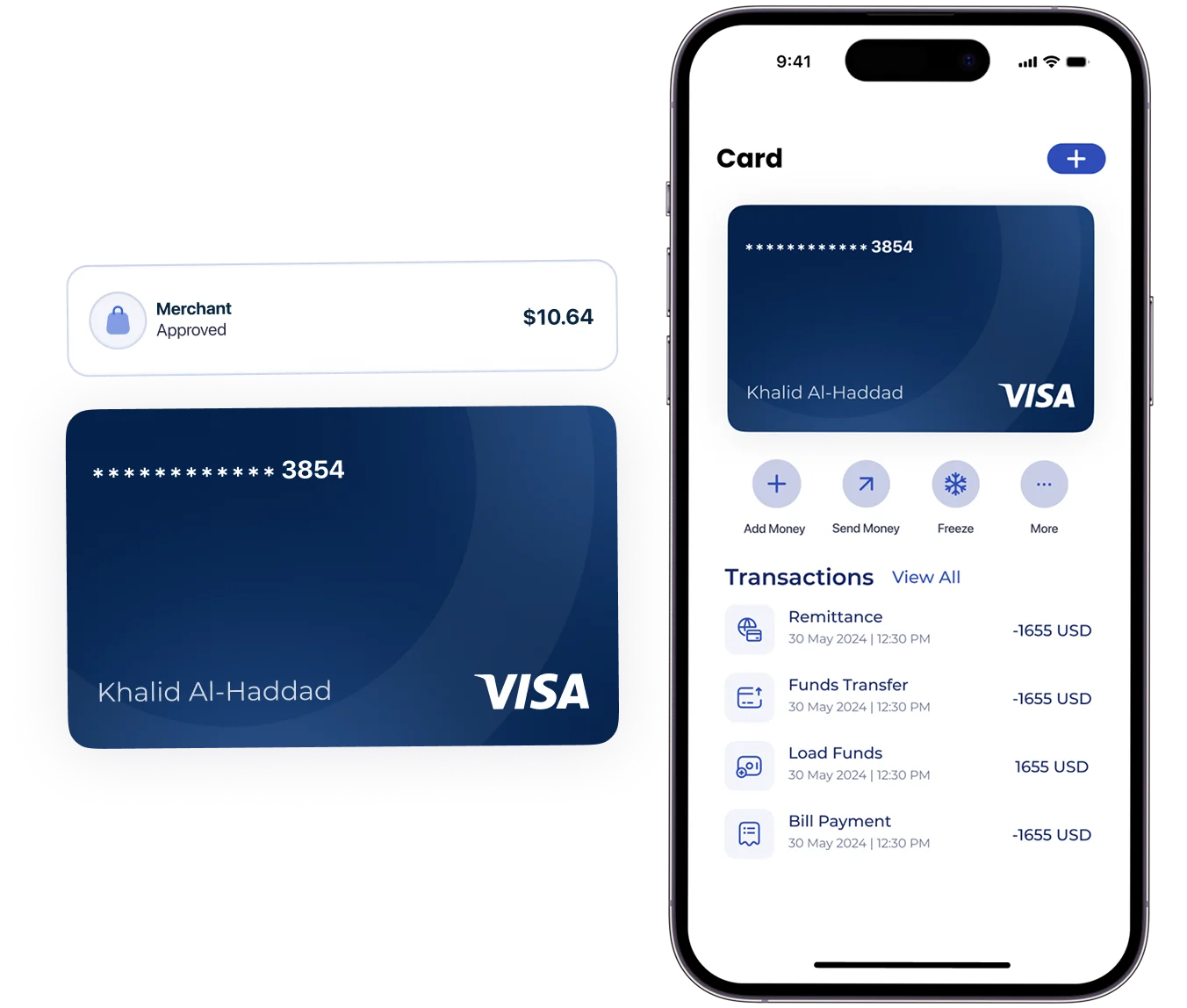

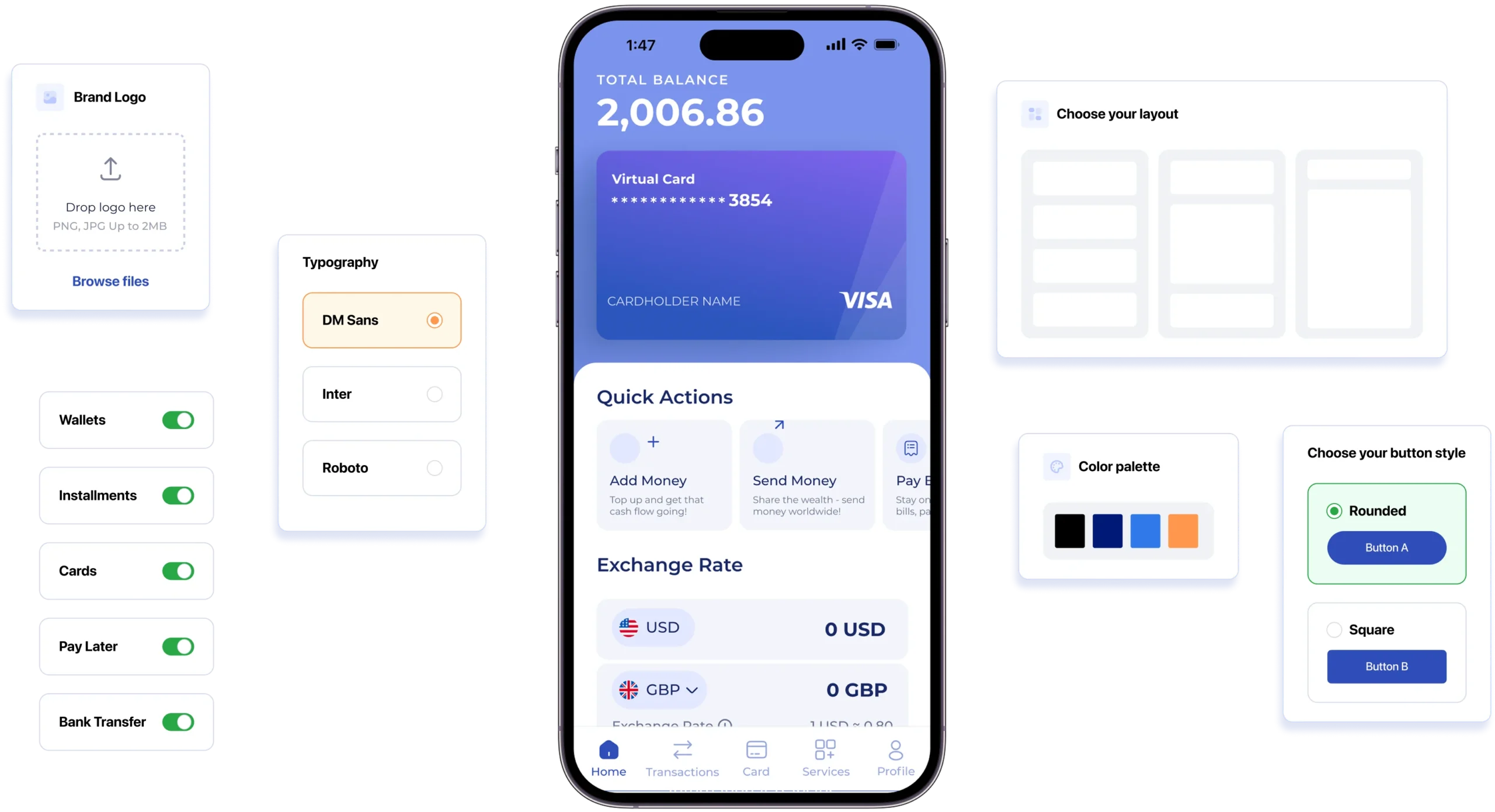

Speed up deployment with pre-built mobile interfaces, built for card management, spend tracking, and compliance—all fully branded to your bank.

From infrastructure to interface, NymCard helps you launch debit programs faster—with less lift, more control, and full compliance.

NymCard values your privacy and seeks to protect it.

You can view our Privacy Policy and Cookie Policy for more details.