Building Trust in Open Finance in the UAE

Open Finance in the UAE is designed to enable secure, regulated access to financial data and services – while ensuring transparency, consent and consumer protection remain at the core.

At the centre of this ecosystem is AlTareq, the UAE’s national Open Finance platform, regulated by the Central Bank of the UAE. AlTareq establishes the standards, governance and controls that allow Open Finance services to operate safely across the market.

NymCard participates in this ecosystem as a licensed Third Party Provider (TPP), enabling approved Open Finance use cases.

Secure. Transparent. Regulated.

Trust is the foundation of Open Finance.

AlTareq operates under the regulatory oversight of the Central Bank of the UAE, ensuring that every interaction adheres to strict standards around data protection, security, and governance.

Through AlTareq:

- Financial data is accessed only by authorised parties

- All interactions are governed by clear regulatory standards

- Data usage is transparent and auditable

This framework ensure that Open Finance innovation progresses responsible and consistently across the market.

Consent at the Core of Open Finance

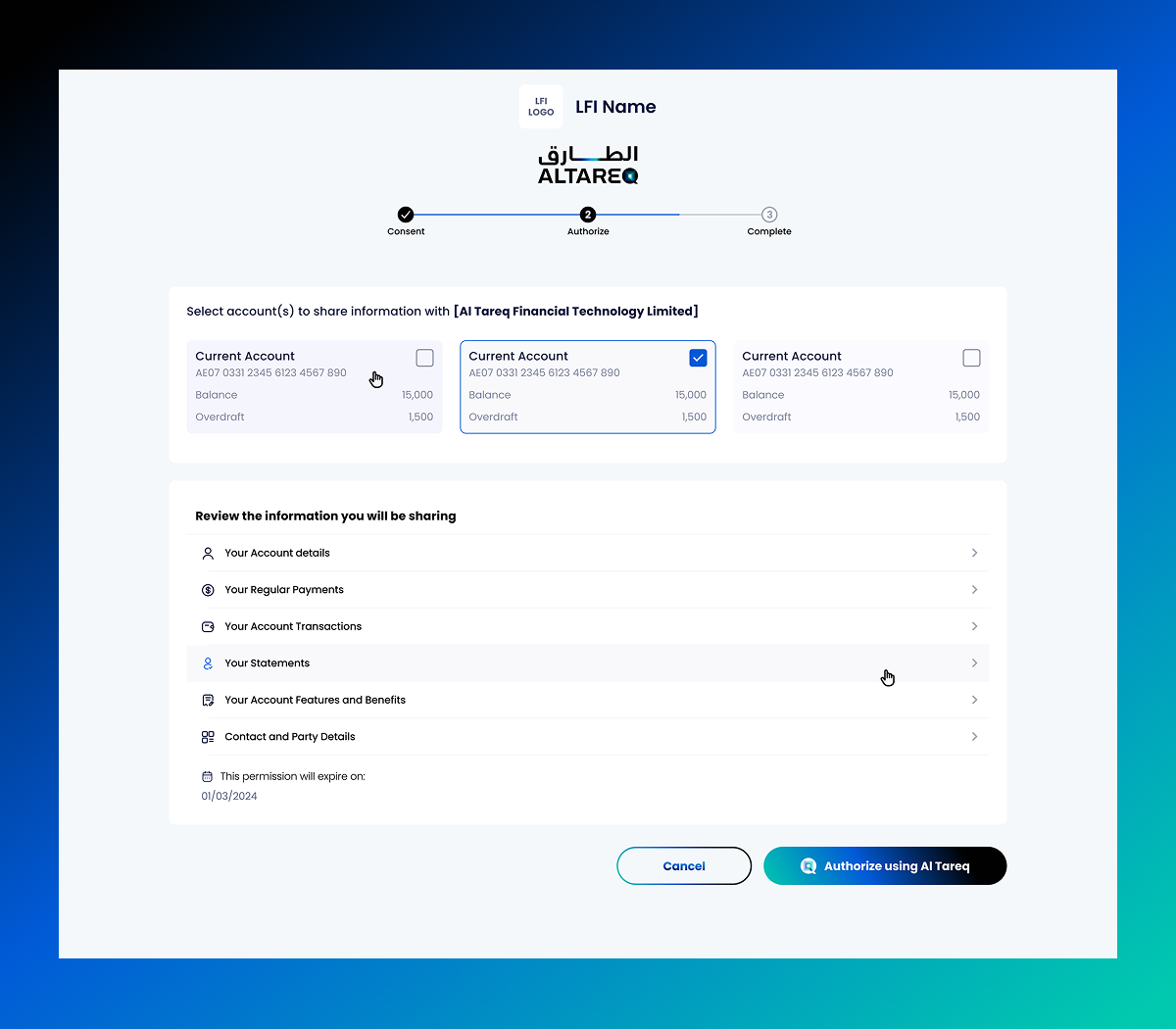

A central principle of AlTareq is explicit customer consent.

No data is shared and no service is initiated unless consent has been clearly granted through an approved process. Each consent interaction clearly defines:

- What data or access is being requested

- The regulated entity involved

- How long the permission will remain active

Consent can be reviewed, paused, or withdrawn at any time, reinforcing transparency and consumer control throughout the Open Finance lifecycle.

World-Class Protection for Financial Data

AlTareq applies strong security and encryption standards to protect financial data at every stage.

This includes encrypted data flows, secure authentication mechanisms, and strict access controls. These measures ensure that sensitive financial information remains protected, while still allowing regulated Open Finance services to operate efficiently and securely.

The Benefits of Open Finance via AlTareq

By creating a secure, consent-driven framework, AlTareq unlocks tangible benefits for customers and financial institutions alike.

Smarter Financial Insights

Open Finance allows for a more complete view of financial information, supporting better-informed financial decisions.

Access to Tailored Financial Offers

AlTareq makes it possible securely access and compare tailored financial quotes from AlTareq-enabled providers, helping improve transparency and choice.

Faster, Simpler Financial Interactions

By reducing repetitive steps and manual processes, Open Finance enables faster and more efficient financial journeys across participating services.

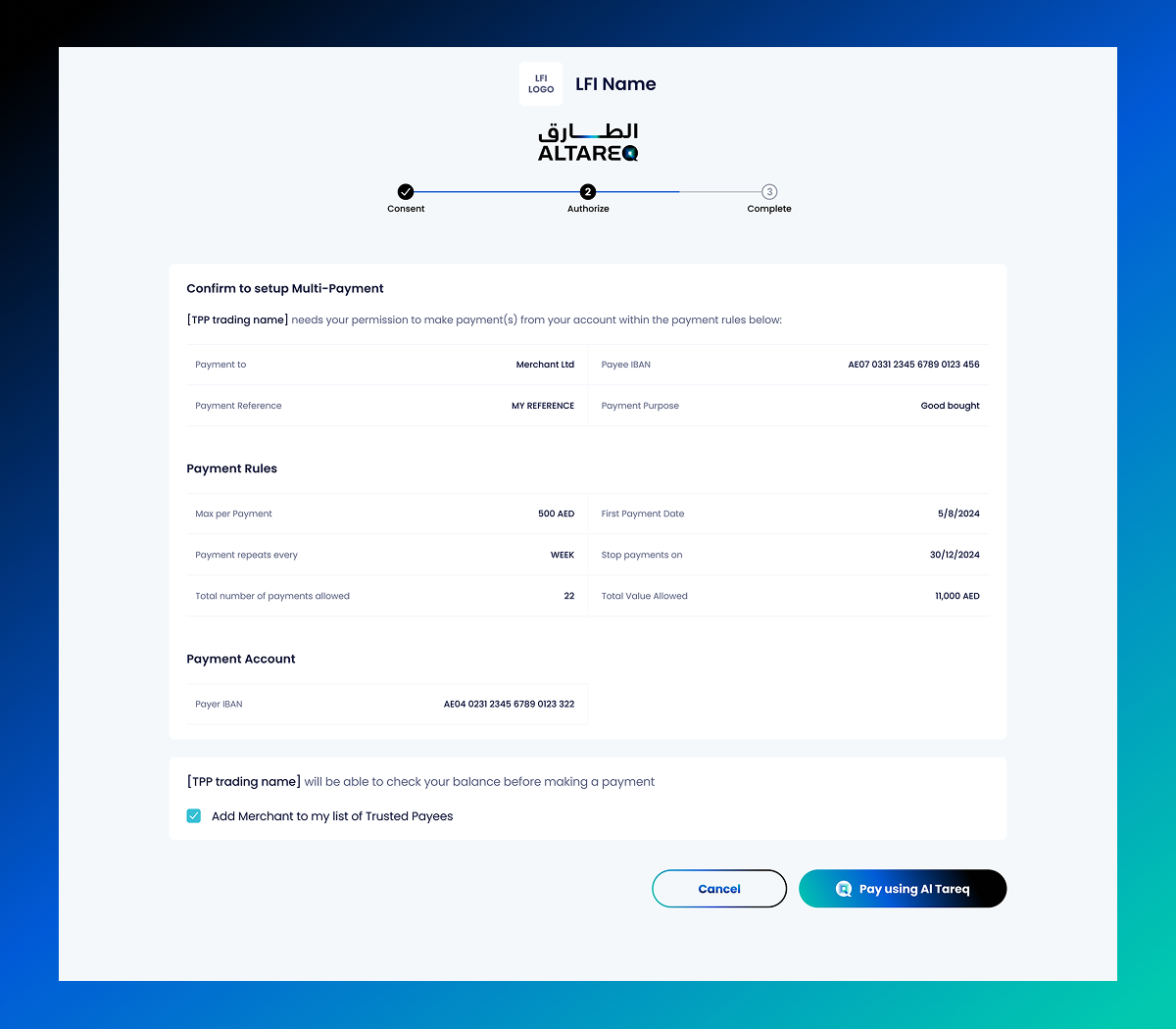

Payment Experiences Enabled by AlTareq

Beyond data access, AlTareq supports modern, consent-driven payment experiences designed to simplify how customers move money.

Automated Payments

Customers can authorise automatic payments within predefined limits—removing the need for repeated approvals, card details, or manual actions.

Real-Time Payments

Payments can be initiated and completed in real time through AlTareq-connected institutions, offering speed without sacrificing control.

Peer-to-Peer Payments

Customers can securely split payments with family and friends—without switching between multiple applications.

AlTareq in 3 Simple Steps

Using Open Finance through AlTareq is designed to be straightforward and transparent.

- Review permissions

Customers are shown the exact data or access required and the institution involved. - Authorise securely

Approval is completed through the customer’s bank, insurer, or exchange house using secure authentication. - Consent is activated

Once approved, the AlTareq connection is established and the service can begin.

Consent can be withdrawn at any time, reinforcing trust and customer control.

NymCard’s Role as a Third Party Provider

As a licensed Third Party Provider (TPP), NymCard:

- Enables Open Finance use cases in accordance with AlTareq’s rules

- Operates within defined regulatory and consent frameworks

- Does not provide consumer-facing financial products

- Does not onboard or connect financial institutions directly

Together, AlTareq and NymCard enable secure, transparent Open Finance services designed for long-term market confidence.

Open Finance gives you control over your financial data and services. With your permission, it lets you securely share your bank, insurance, mortgage, and other financial information with and initiate services via regulated providers to access more personalized, innovative, and convenient financial services.

Frequently Asked Questions

1. Introduction to Open Finance

1.1 What is Open Finance?

Open Finance gives you control over your financial data and services. With your permission, it lets you securely share your bank, insurance, mortgage, and other financial information with and initiate services via regulated providers to access more personalized, innovative, and convenient financial services.

1.2 What is Open Finance called in the UAE?

Open Finance is known as AlTareq in the UAE. You will see this name and logo when using Open Finance services provided by banks or insurers, exchange houses or brokers, and Third-Party Providers. Examples include:

• An insurance comparison website

• An e-wallet and payments app

• A financial aggregation and insights app

• A foreign exchange comparison and money sending service

1.3 Why was Open Finance introduced and how is it implemented in the UAE?

The Central Bank of the UAE (CBUAE) launched Open Finance to modernize the financial sector and give you more choice and convenience. AlTareq, the name for Open Finance in the UAE, will offer functionality that securely connects all Licensed Financial Institutions and Third-Party Providers/apps via a central platform. Open Finance will support four key functionalities including data sharing, quote generation, service and transaction initiation, and onboarding to Licensed Financial Institutions.

1.4 Who is involved in Open Finance?

- Central Bank of the UAE (CBUAE): The regulator ensuring the safety, transparency, and fairness of the Open Finance ecosystem.

- Nebras: The operator of the central platform for Open Finance and manager of initiative for the UAE.

- Licensed Financial Institutions: Banks, insurers, foreign exchange houses, e-wallets, and finance houses licensed by the CBUAE to securely share consented user data with Third-Party Providers.

- Third-Party Providers: Regulated providers utilizing open finance functionalities to provide new ways to use financial services.

- Users: Consumers and businesses as end users of AlTareq services who benefit from innovative services provided by regulated Third-Party Providers.

1.5 How does Open Finance work?

With your explicit consent, Open Finance allows regulated Third-Party Providers

to securely connect to banks, insurance companies, exchange houses and other.

The connection is made via an API (Application Programming Interface); this is

the same type of connection your mobile phones uses to connect your photos app

to your social media apps, however we add the highest grade of security to the

connection. This enables Third-Party Providers to offer enhanced financial

products and services tailored to your needs.

2. Getting Started

2.1 Who benefits from Open Finance services?

Open Finance empowers both individuals and businesses by providing them with

access to an enhanced range of financial products and services.

2.2 How do I start using Open Finance services?

You can access Open Finance services through regulated Third-Party Provider apps

or platforms if you give consent for data sharing/ service initiation to a specific provider.

2.3 What is the AlTareq Consent Mobile App?

The AlTareq Consent Mobile App allows you to give permission and manage what

financial data you share through Open Finance. It’s a trusted, centralized app that lets

you approve payments, share data, and control all your consents, in one place, across

Licensed Financial Institutions and Third-Party Providers.

2.4 Am I automatically enrolled in Open Finance?

No. Open Finance is completely voluntary. You actively give consent before any data

is shared or services are provided. You can manage or cancel your consent at any

time through:

- AlTareq Consent Mobile App

- Your Licensed Financial Institution’s platform

- Your Third-Party Provider’s platform

2.5 How does Open Finance benefit me?

Open Finance enhances how you access and leverage financial services through:

- Secure data sharing: Track your spending, get insights, and use financial tools

tailored to you. - Product and Service Quote Generation: Compare insurance, banking, and exchange offers quickly and easily and select the best fit for you.

- Streamlined Service Initiation: Make any type of payment, open new accounts, execute contracts, and complete transactions—all in a faster, more streamlined way that’s even possible to be embedded within a non-financial service.

2.6 Where can I find more information on Open Finance?

You can find additional details on the Nebras website.

3. Open Finance Security Controls

3.1 Is Open Finance safe?

Yes — your safety and privacy are at the heart of Open Finance.

Only providers that are licensed and regulated by the Central Bank of the UAE

(CBUAE) can access your data, and only with your clear, informed consent. Open

Finance is built with world-class levels of protection, using advanced security tools like

multi-factor authentication and encryption to ensure your information and financial

services stay private and secure.

3.2 What security features are in place?

Open Finance uses multiple layers of protection to ensure security:

- Private by design: End-to-end encryption ensures your data is protected

whenever using AlTareq-based services. - Strict oversight: All providers are regulated and closely monitored by the CBUAE to ensure they meet the highest standards of security and reliability.

- Your control, always: You decide who gets access to your data/ services and for how long. You can pause or revoke your consent at any time.

- Strong identity protection: Multi-factor authentication offers security every time you give consent or initiate services.

3.3 What is multi-factor authentication?

Multi-factor authentication adds an extra layer of security to verify your identity when

giving consent to data sharing or service initiation. It requires you to provide at least

two of the following forms of identification:

a) something you know (like a password)

b) something you have (like an authentication app)

c) something you are (like facial recognition)

3.4 How do I give consent?

Consent will be initiated through your Third-Party Provider’s app and consent

authorization will be confirmed either through your Licensed Financial Institution’s

app or the AlTareq Consent Mobile App. You can view, pause, or cancel your

consent at any time through any of the abovementioned platforms.

3.5 What types of data are shared through Open Finance?

With your consent, Open Finance allows the sharing of:

- Personal details such as name, address, and employment information.

- Account details such as account name, account number, account balance, and transaction history.

- Insurance information such as policy numbers, coverage specifics, and claims history.

- Foreign exchange data such as currency types, transaction amounts, exchange rates, and transaction dates.

- Payment details such as direct debits, standing orders, and the updated account balance after each transaction.

3.6 How do I revoke or suspend consent for data sharing or service initiation?

You can revoke or temporarily suspend consent through:

- Through the AlTareq Consent App

- You can view, pause, or cancel your consent at any time.

Through your Licensed Financial Institution/ Third-Party Provider’s app

3.7 How long is my consent active?

Consent automatically expires after a maximum of one year. You will need to extend

consent if you want the AlTareq-based services to continue. You can also temporarily

suspend or completely revoke consent at any time through your Licensed Financial

Institution/ Third-Party Provider platform or the AlTareq Consent Mobile App, giving

you control over your data sharing preferences and service initiation permissions.

3.8 Who controls my personal data?

You have control over your personal data. You decide who sees your data, what they

see, and when they can see it. You can stop access at any time and when you do, the

Third-Party Providers are obliged to delete your data which is not required to be

retained by law or regulation.

3.9 Are there regulations/ legislation that protect users?

Yes, the CBUAE Open Finance Regulation establishes a comprehensive framework

for the licensing, supervision, and operation of Open Finance in the UAE. It outlines

the requirements and license conditions for Open Finance Third-Party Providers,

ensuring that only regulated organizations can engage in data sharing and service

initiation. For more detailed information, please refer to the Open Finance Regulation.

3.10 What happens if a security breach occurs?

If a breach happens, the bank, insurer, or Third-Party Provider must notify you

immediately and address the issue. Open Finance uses centrally operated security

measures to prevent this from happening. There is a comprehensive liability model for

AlTareq which compensates users in the event of any performance issue or security

breach in addition to the protection provided by UAE law.

3.11 What happens if suspicious activity is detected in my account?

If suspicious activity is detected, the Licensed Financial Institution may trigger security

protocols, such as requiring additional authentication, temporarily blocking

transactions, or notifying the user for manual verification. If fraudulent activity is

confirmed, the concerned Licensed Financial Institution or Third-Party Provider must

take corrective action.

3.12 How do I check if a provider is regulated?

You can find this information in the AlTareq directory on the Nebras website.