Open Finance

Open Finance Infrastructure

Enable Open Finance capabilities through a single infrastructure layer — powering data access and payment initiation for banks, fintechs, and enterprises.

Why Open Finance

NymCard delivers the underlying technology required to support Open Finance use cases — operating behind the scenes as an infrastructure provider, not a consumer-facing platform.

Our role is to enable secure connectivity, orchestration, and scale, while our partners own the customer experience.

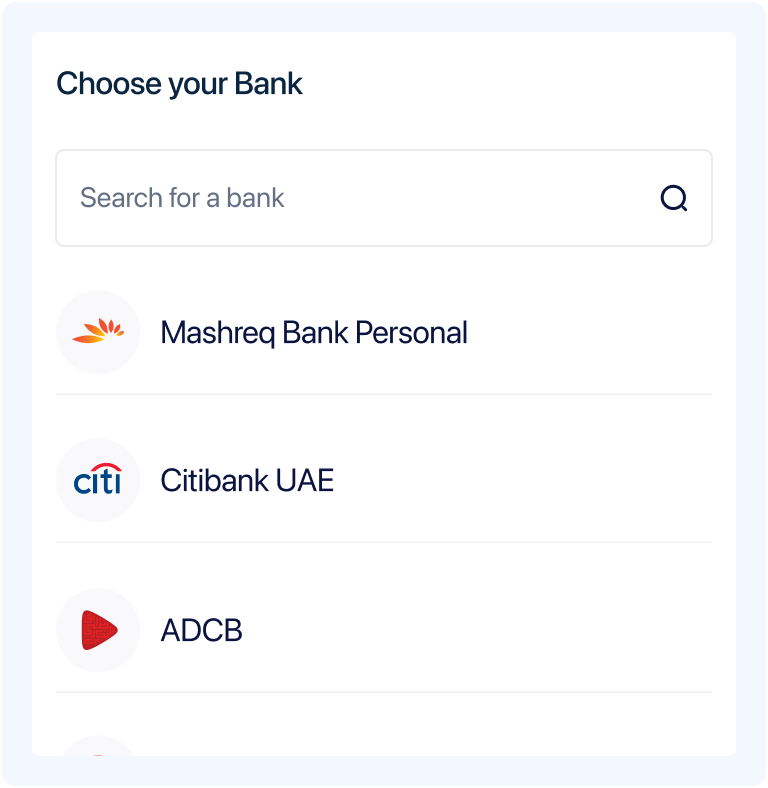

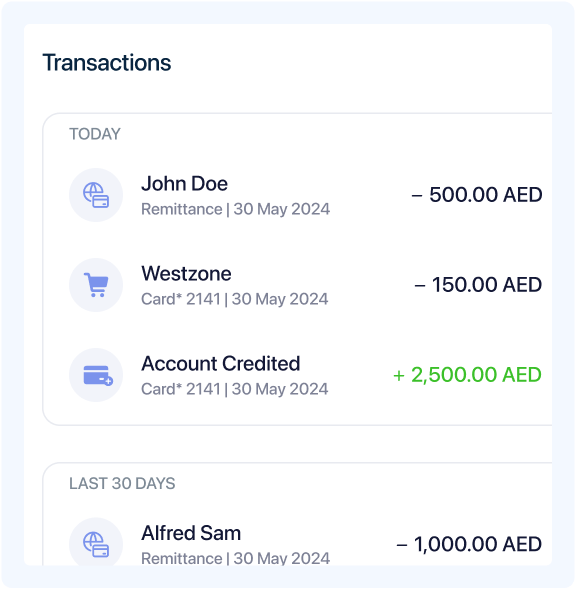

Account Information

Access customer-authorized financial data through a single API integration.

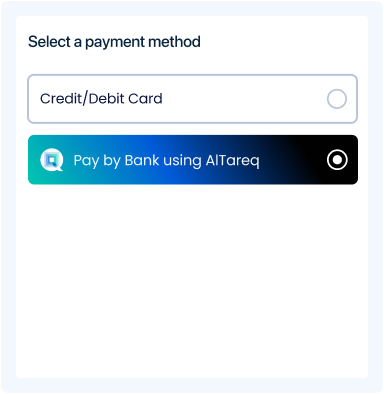

Payment Initiation

Enable Open Finance payment flows through customer-authorised bank connections.

Data Enrichment

Transform banking data into data into structured insights that support smarter decision-making across payments, lending, and risk.

Corporate Open Finance Solutions

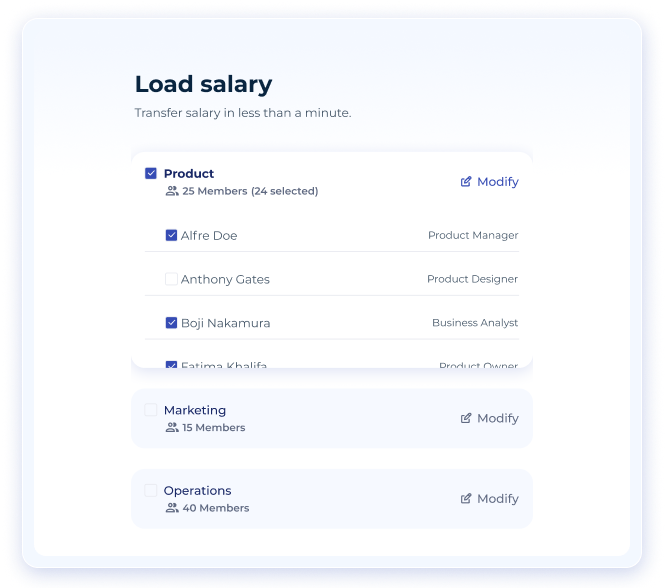

Bulk Supplier & Payroll Payments

Automate payouts and salary transfers in real time.

Treasury & Liquidity Management

Move funds instantly across accounts with full visibility.

Automated Loan Disbursements

Distribute corporate credit and business loans with zero delays.

Instant KYCB & Onboarding

Verify business clients instantly with secure bank data.

Live Balance & Income Verification

Get real-time visibility into corporate accounts and cash flow.

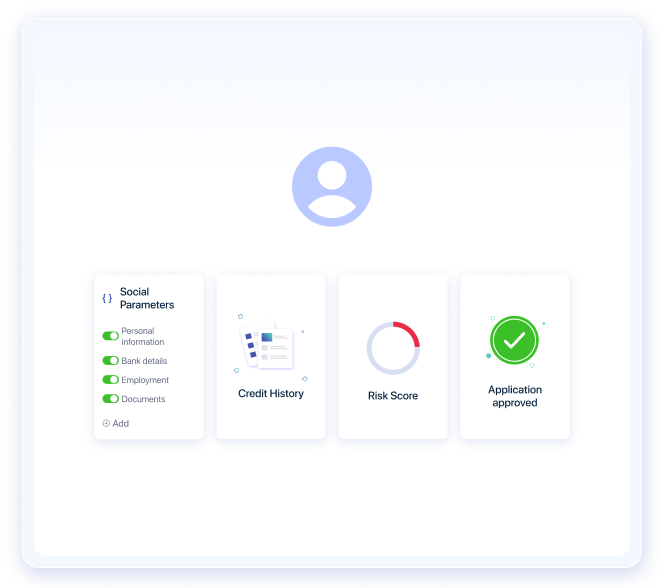

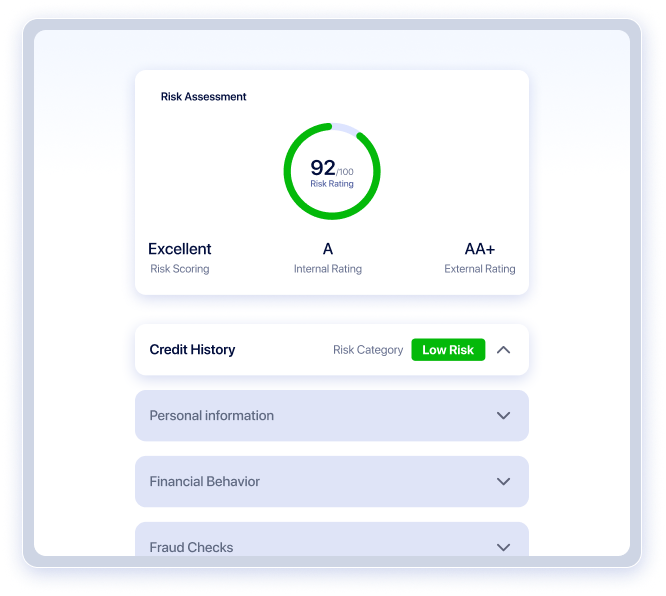

Risk Scoring & Fraud Prevention

Get real-time insights into cash flow and financial health.

Consumer Open Finance Solutions

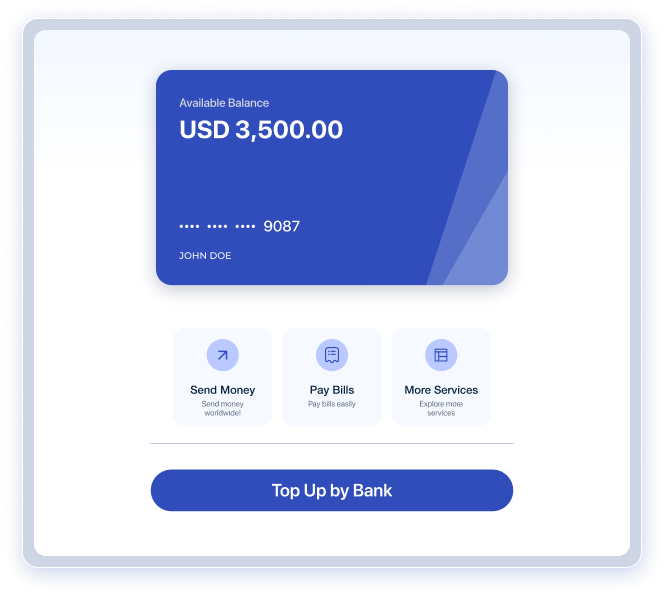

Instant Card Top-Ups

Fund prepaid and debit cards instantly from bank accounts.

Direct Bank Transfers

Pay merchants and move funds with real-time account payments.

Loan & BNPL Payouts

Disburse personal loans and BNPL funds instantly.

Instant KYCB & Onboarding

Verify business clients instantly with secure bank data.

Live Balance & Income Verification

Get real-time visibility into corporate accounts and cash flow.

Risk Scoring & Fraud Prevention

Get real-time insights into cash flow and financial health.

How Open Finance enhances the broader ecosystem

Beyond Open Finance

One platform. One integration. Unlimited potential.

Our Open Fiinance APIs connect to our full-stack platform—helping you launch, scale, and optimize financial products without complexity.

Card Issuing

Our Open Banking APIs connect to our full-stack platform—helping you launch, scale, and optimize financial products without complexity.

Embedded Lending

Our Open Banking APIs connect to our full-stack platform—helping you launch, scale, and optimize financial products without complexity.

Money Movement

Our Open Banking APIs connect to our full-stack platform—helping you launch, scale, and optimize financial products without complexity.

We've got you covered

Trusted & Licensed

Regulated by CBUAE and connected to major payment schemes.

Scale without limits

One platform to build, launch, and expand across payments, lending, and money movement.

Highly Secure Technology

ISO 27001 & PSD2-licensed, meeting the highest security standards.

Go live faster

Developer-friendly APIs & SDKs for easy integration.

Reduced operational costs

Automate finance, lower fees, and eliminate inefficiencies.

Future-proof infrastructure

Modular, flexible, and built to support evolving financial services.

Build on Open Finance Infrastructure

We’re here to help you make the most of open finance use cases via AlTareq.